When our firm starts working with a business owner to address QuickBooks errors and other challenges, we often look for common red flags that pop up on a regular basis. We’d like to highlight these errors and show you how we can fix QuickBooks to support your business. Under Asset Information, enter the Asset Description , its Location, PO Number if applicable, Serial Number and warranty expiration date. Add Notes if you ‘d like, and you’re done–unless you want to incorporate Custom Fields.

Common Issues section to view a report showing those transactions. With your accountant to ensure you are recording it correctly for your particular circumstances. Since we previously discussed a contractor’s chart of accounts, let’s dive into an industry-specific… Change the account from Uncategorized Expense to the correct expense account.

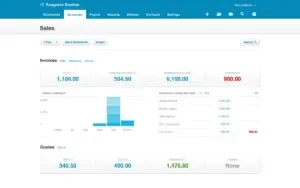

Accounts reconciled

Finally, retained earnings are QuickBooks’ automatic chart of accounts that rolls over net income every year. It is a lifetime net income or loss of the company. That was a quick summary of the balance sheet accounts that we see used by contractors across the board. When considering contractor-specific assets, the leading fixed asset we see are vehicles. These are important to record accurately because there are a lot of parts to recording a vehicle on your books.

A/P allows for the cost of goods sold or expense accounts to accurately depict their values at any given time. Finally, an undistributed tips account is a more uncommon current liability that contractors may find beneficial. This liability is where tip payments go when received but are not yet paid out to the recipient. Unfortunately, this can complicate things very quickly. Sometimes, business owners will tie together their personal credit cards or personal bank accounts to the business’ books. This can complicate your ability to produce accurate reports.

The Ultimate Guide to Uncategorized Expenses

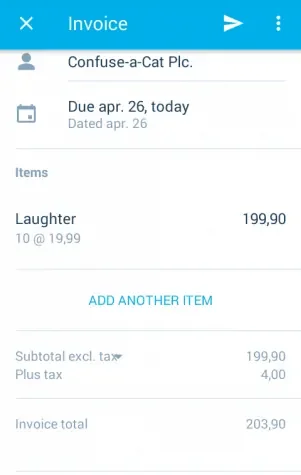

To share her knowledge she has written a series of courses titled Simplified Accounting Solution, which provides step-by-step guidance for those working with QuickBooks. Limit the number of business bank accounts that you use. Using one business bank account will simplifies your accounting. Process daily or weekly all items in the for-review panel for each bank and credit card account. The QuickBooks payment section is for invoices that are paid via QuickBooks Payments. QuickBooks will automatically record the receive payment document.

xero bank transfers assets, of course, are long-term resources that you don’t intend to consume or sell within the fiscal period in which you purchased it. As a result, most types of equipment are considered fixed assets. You may keep a piece of equipment for several years, all while using it to facilitate your business’s money-making activities. Because equipment is typically a fixed asset, that’s how you’ll need to record it in Quickbooks. Keep separate your personal and business bank and credit card account, if possible.

- The banking center is where you’ll process any new bank and credit card transactions.

- For this reason, reconciling your bank accounts is very important.

- In accounting, fixed asset accounts appear on the company balance sheet.

- When considering contractor-specific assets, the leading fixed asset we see are vehicles.

Review your bank account online for those missing checks or deposits to verify they were received and cleared after the bank statement was issued. The Banking Feed will find individual checks there and match them automatically. And when you take checks to the bank, create a Bank Deposit to gather them into a group that matches the total amount on the deposit slip, the Banking Feed, and your bank statement. Also, fill out the physical deposit ticket with an itemized list so you have a record of which transactions created that total. Even better, use your phone app to deposit checks, so the amounts easily match. Taking a few minutes to pay attention to details when adding transactions from the bank feeds page into your books can save a lot of time and agony later.

Important Accounting …

More than 11,000 volunteer business mentors in more than 300 chapters serve their communities. If you don’t find a matching document, go to one of the next steps. If the bank accidently duplicates a transaction, you can move the duplicate entry to the excluded tab marked SEVEN.

Then click on each of the 3 https://bookkeeping-reviews.com/ and edit it so it goes to the correct account. Now you can only change a transfer to a balance sheet account like owners equity or a liablity or another asset account. A common error with bank feeds is found in customer invoices and deposits from customers duplicating sales. Take extra time with sales deposits to make sure the correct customer and correct invoice receives the payment. Be careful to ensure the deposit received through bank feeds doesn’t deposit into sales income, leaving the customer invoice unpaid.

When our team sees negative numbers in things such as a P/L Statement or a Balance Sheet report that are generated by QuickBooks, then we know there is an error. We can tell right away that something is off. In theory, it’s possible to have something like a negative account balance, but the way QuickBooks is set up, it’s incorrect from an accounting standpoint. You can double-check your actions by clicking on the Reconcile button. You’ll get a warning that your beginning balance is off by the value of transactions you’ve unreconciled.

ANNOUNCEMENT: Employment Opportunity – Accounts Clerk – Dominica News Online

ANNOUNCEMENT: Employment Opportunity – Accounts Clerk.

Posted: Mon, 07 Feb 2022 08:00:00 GMT [source]

Once the credit card payment from the checking account bank feeds have been added, go to the credit card bank feeds. QBO has a protective feature that holds the transactions on the banking page like they are still sitting on your bank statement until you add them to your books. Until you move transactions from bank feeds to your books, they are not in your books. Using this feature intelligently will prevent hours of troubleshooting later.

NEWQBO.COM – NOT AFFILIATED WITH INTUIT QUICKBOOKS

Let’s look at four common reasons why you might have to undo reconciliation in QuickBooks Online. Print the report or duplicate the tab and move the tab with the reconciliation report to a different monitor. This will let you quickly reference the report as you’re working to undo the reconciliation. Amrita Jayakumar is a former special assignments writer for NerdWallet. She also wrote a syndicated column about millennials and money, and covered personal loans and consumer credit and debt. Previously, she was a reporter at The Washington Post.

Clickthe checkbox beside each of the four receive payment documents. Verify that the deposit document equals the bank deposit ticket. Every accounting transaction is a two-sided transaction that will impact two or more accounts.

Uncat automatically notifies your client when there are transactions that need answers. I appreciate you getting back to us, @gingerbreadquilt. I’ll clarify some things about the tabs, so you can record and match the transactions properly. I went to the video about downloading transactions from the bank and how to categorize them.

For a reconciled transaction, you’ll see an R in the checkmark column. Click the View Register on the Action Column and locate the transaction to change. You can use a filter to only display reconciled transactions in the bank register. Why bother to do your books if you’re not doing them correctly?