A source document or business document serves as the foundation for recording a transaction. If you’re still feeling uncertain, don’t be afraid bookkeeper to speak with a professional bookkeeping service about securing their help. This can be as simple as a statement showing your current cash position, expected upcoming cash receipts, and expected cash payments for this period. There are many accounting project management solutions with clean and straightforward user interfaces perfect for non-techy entrepreneurs. Investing in a professional tax accountant can bring immense value to your business, with a time commitment of a few hours per week or month. An Institute of Business Forecasting and Planning study confirms that businesses can save up to $3.5 million per year with accurate financial forecasting.

- When you review the sales shown on your financial reports for the past few months, you can get insight into your future sales.

- Besides keeping you cognizant about your business’ past and present performance, small business accounting also helps in generating invoices and completing payroll.

- However, once the business has sufficient discretionary funds, it’s best to outsource these tasks to an accountant or a bookkeeper.

- When you implement a proper bookkeeping system, you can get up-to-date, accurate records, avoid missing transactions, and have better control over your business savings account.

- If you have employees, you’ll need to send them and the IRS W-2 forms.

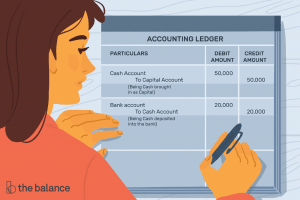

The last thing you want to do is sit down and go through each and every shopping list or personal transaction to find specific business expenses. The debited account is the one that receives or loses value, and the credited account is the one factor accounts receivable assignment without recourse that gives or gains value. The golden rules of accounting can help ensure that your bookkeeping is accurate and up-to-date. Accurate financial records are the foundation of good bookkeeping.

Be Prepared for Large Expenses

This is done to test if the debits match the credits after the adjusting entries are made. This is the final step before the preparation of the business’ financial statements. While you’re at it, you’ll be able to identify trouble spots and make adjustments to improve your business. While accounting may not be what motivates you to go to work every day, it’s likely something you’ll encounter whether you do it yourself or outsource to an accounting firm. There are weekly, monthly, quarterly, and annual accounting tasks you need to complete to ensure your business’s success. There are numerous types of outsourced bookkeeping services you can hire.

Though several activities stake their claim on your time, accounting and bookkeeping form a significant chunk of your workload. Having a solid overview of your bookkeeping and accounting reports gives you a good enough start for cash flow projections for the following months. Accurate records increase a small business’s chances of success.

What are some common tax deductions for small business owners?

According to the NSBA Small Business Taxation Survey, filing and completing their federal income tax returns is one of the top concerns ledger account definition for small business owners. Profit and loss statements is a recap of your business expenses, costs and revenues on specific dates. Many expenses may be deductible from federal income taxes, in whole or in part, depending on your business’s circumstances.

Top Bookkeeping & Accounting Tips for Small Businesses

Understanding helps identify shortfalls, discrepancies, and other issues that are important to catch early. However, you may reach a point where no enthusiasm or persistence level can help. Bookkeeping is often the first aspect of the business to suffer. All you have to do is scan the paper, check the details, then move on to the next one.

Consider getting a separate credit card to pay for business expenses. This will help you track the business-related expenditure and separate it from your personal finances. Develop a method of handling your data, actively managing your cash flow and reviewing your monthly and bank statement regularly. Organize your receipts (including receipts for charitable contributions) and accurately record deposits. A small business should estimate its income taxes during the year based on its growth and projected pretax income. Small businesses, including online businesses, usually make quarterly estimated federal tax payments if they expect to owe more than $1,000 for the year.

“Muddy waters in this area are never welcome when it comes time to file your taxes,” she said. The two key accounting systems are cash accounting and accrual accounting. If your business is still small, you may opt for cash-basis accounting. If you carry inventory or have accounts payable and accounts receivable, you’ll likely use accrual accounting. The requirements of small business accounting come down to a handful of best practices and essential reports, which you can do manually or with accounting software. Other accounting services small businesses may use include bookkeeping, strategic finance, and tax accounting.