The mobile app for Online is robust, and Desktop’s mobile app is so limited, that it essentially functions as a receipt uploader. Working from the cloud means you need an internet connection, so a poor signal or an intermittent connection can be an issue. If you need help with bookkeeping, QuickBooks offers two options. Assisted Bookkeeping is available as an add-on for $50/month, or you can pay for QuickBooks Live Full-Service Bookkeeping with rates starting at $300/month. While the software is easier to use than its locally-installed counterparts, you may face occasional navigational difficulties.

QuickBooks Self-Employed pricing

Check out a few of our favorite QuickBooks alternatives to see if any of them are a better fit for what you’re looking for. One of the selling points of QuickBooks Self-Employed is its ability to calculate your quarterly estimated taxes for you. However, if you want to pay these taxes directly through QuickBooks, you’ll need to upgrade to a special tax prep plan.

QuickBooks Online Plus+ Payroll Core

At the Core pricing level, the automated tax filings, basic reporting features, and basic benefits management programs are enough to help a small business with a handful of employees. As a business grows and the HR requirements increase, the offerings at the Premium and Elite levels may align better. QuickBooks Online is cloud-based accounting software that covers all the accounting needs you may have. It’s a subscription-based service that is good for various industries and beneficial to those who regularly work with a bookkeeper or accountant because you can give them access to your files.

Why You Can Trust Fit Small Business

With Plus, you can create projects and add income, expenses, and wages. The Projects tool helps you manage different jobs and projects for your clients and track costs related to labor and materials. However, the problem with Plus or any of the other versions is that you can’t compare cost estimates to actual costs by project.

QuickBooks Online Simple Start Pricing

You can easily add tax details, connect bank accounts and set up your business. Businesses with product inventory find AccountEdge Pro very useful, thanks to the robust inventory module. FreshBooks has four pricing plans that start at $15 per month. Sage Business is a small business accounting software mostly known for its user-friendliness. Originally known as Sage One, Sage Business was launched in 1981 in England.

You’re our first priority.Every time.

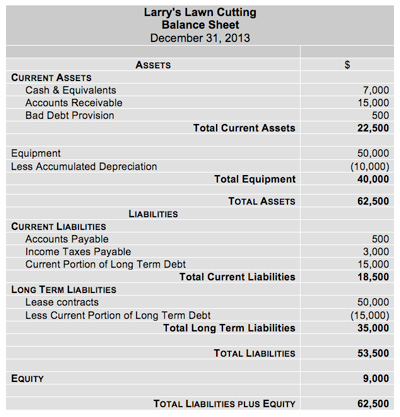

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions. You also benefit from the flexibility that the application provides. There are other accounting applications and some of them are pretty good, but QuickBooks Online remains the best one. This accounting application can be a powerful tool for a business owner with a strong work ethic. Whenever you initiate a new settlement, QuickBooks detects it and makes a summary of expenses. To help optimize cash flow for businesses, Fundbox uses engineering, big data analytics and protective modeling.

However, they will allow you to easily create an invoice and keep track of your accounting for free. We looked at a wide range of data quality solutions to compile https://www.quickbooks-payroll.org/ this list of the best software. We assessed different parameters for each software, including its usability, scalability, standout features and customer support.

However, Xero has a few advantages because it supports unlimited users at no additional cost, making it a solid choice for larger businesses. On the other hand, QuickBooks is easier to learn, has strong mobile apps, and has tax support. QuickBooks Online is one of the preeminent cloud-based accounting software platforms on the market. With five plans what is the discount on note receivable journal entry example and calculation available, including a plan specifically for self-employed individuals and independent contractors, there are several options from which to choose, depending on your needs. In this guide, we’ll break down QuickBooks Online pricing, including plans, key features, and alternative platform costs so you can decide which option is best for you.

Businesses that provide services, rather than goods, should consider the QuickBooks Essentials plan. Businesses with inventory will likely get the most benefit from QuickBooks Plus. Large businesses that need access for up to 25 users will probably want to go with QuickBooks Advanced. Although QuickBooks Online is a great cloud-based accounting platform, it isn’t the only one. There are four QuickBooks Online plans, and the Plus plan is the most suitable one for small businesses. The Plus plan allows up to five users, and that is a great advantage for most small businesses.

There are several invoicing software on the market, so it’s a good idea to do some research before choosing one for your business. We’ve compared QuickBooks with its competitors to help your search. QuickBooks invoices are optimized for mobile, which means customers will be able to view them properly if they are on their mobile device. Note that Intuit often runs promotions that reduce the first three months of its plans by as much as 70%. Somewhere between Zoho’s grow-as-you-go philosophy and NetSuite’s go-big-or-go-home design, Sage 50 Accounting offers the biggest benefits to midsize businesses. Sage is a provider of a number of business solutions, catering to different operational needs and organization sizes.

- Some, however, just need an easy, reliable way to track the work they do, the invoices they send and the payments they receive, and this is where FreshBooks comes in.

- We spend hours researching and evaluating each accounting software system we review at Merchant Maverick, placing special emphasis on key characteristics to generate our ratings.

- Fundbox is very useful for small businesses that need some extra investment.

- It’s user-friendly, flexible and affordable, especially in comparison to more enterprise-grade solutions.

Another cumbersome feature that users don’t like is the requirement that clients must establish their own accounts to pay an invoice. Other popular merchant processors don’t require this, making collecting payments more difficult. Offers four plans to accommodate a range of businesses https://www.accountingcoaching.online/what-is-accounts-receivable-days-formula/ with different needs; each plan limits the number of users, though. Small to midsize businesses that want a desktop solution or need advanced inventory and industry-specific features. Overall, QuickBooks Online has a lot to offer in terms of features, accounting, and usability.

I enjoy being able to work on our books from any computer or even a cell phone. Previously I could only access our bookkeeping records by physically going into our office. Bank-level security keeps your data stored safely in the cloud. Access real-time financial data on any device, anytime, anywhere. All plans come with a free 1-to-1 session with a member of our onboarding team, who can help guide you through setting up QuickBooks for your business. Cassie is a deputy editor collaborating with teams around the world while living in the beautiful hills of Kentucky.

What people didn’t like was the difficulty of navigating past transactions and the lack of customizations for reporting. Customer reviews of QuickBooks Self-Employed noted that it’s very easy to use and has an interface that’s simple to navigate. On the negative side, some people noted a delay when tracking purchases, which makes it hard to see up-to-the-minute finance tracking.