Let’s look at an example of a proprietary ratio to better understand the concept. The higher the ratio, the more the shareholders will expect to receive in a liquidation payout (and vice versa). Also, the machine required to make these bags is available at a purchase price of $5000. Now, there are two methods by which, I could not only get this machine but also manage the leverage of the company. The word “Proprietors” is a synonym for “owners of a business”, proprietors’ funds, in this case, would only be the funds which belong to the owners/shareholders of the business.

B. Overall Profitability

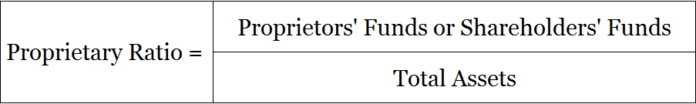

Using the proprietary ratio, you can measure the stability of a company’s capital structure. This shows that 60% of the company’s assets are funded by its equity, which suggests a stable financial position with less reliance on external debt. We know that shareholders’ fund is also known as proprietors’ fund or the funds contributed by the owners in a company or a business. Keep reading as I will further break down the meaning of proprietary ratio and tell you how to calculate it.

Great! The Financial Professional Will Get Back To You Soon.

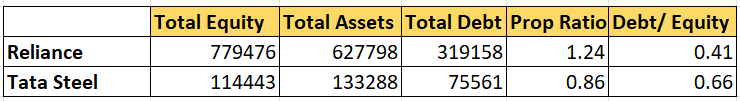

This equity ratio falls under the broader category of solvency ratios, which gauge a company’s ability to meet its long-term obligations. A high proprietary ratio shows that a significant portion of the company’s assets are financed by shareholders, not debt. The higher this ratio, the more financial stability a company is considered to have.Please note that these figures are subject to change as companies release new financial data. Actual figures should be confirmed from the latest financial statements of the respective companies. Proprietary ratio shows the total assets of a company which are financed by proprietors’ funds. It helps to determine the financial strength of a company & is useful for creditors to assess the ratio of shareholders’ funds employed out of total assets of the company.

Analysis of Capital Structure or Leverage

The result will be more accurate of the company’s valid condition if you exclude goodwill and intangible assets from the denominator. The what is accounts receivable days formula and calculation does not disclose any clear data about the company but should know the holistic concept of this ratio. Which, if you see that Reliance has lower debt compared to tata steel, but has a high proprietary ratio. On the other hand, if the ratio is low, it means that the company may be using more debt to support its business than equity.

- It is also known as equity ratio or shareholder equity ratio or net worth ratio.

- The proprietary ratio is calculated by dividing proprietors’ funds by total assets.

- The proprietary ratio of 64% means, 64% of the total assets of the company are financed by proprietors’ funds.

The ideal ratio of proprietary ratio depends on the nature of the business as well as the investor’s risk appetite. The result will be more accurate of the company’s valid condition if you exclude goodwill and intangible assets from the denominator. This indicates that the company has a negative net worth and may be in financial distress. A negative ratio can also mean that the company has a high amount of debt financing relative to its equity financing, making it vulnerable to financial risks and reducing its creditworthiness. This ratio establishes the relationship between shareholders’ funds and total assets of the firm.

How Does GooglePay Earn Money? (GooglePay Business Model Revealed)

Others may be less capital-intensive or may have more retained earnings, leading to a higher ratio. Therefore, the Proprietary Ratio is often used in conjunction with other financial ratios when analyzing a company’s financial health. The proprietary ratio is expressed in the form of a percentage and is calculated by dividing the shareholders equity with the total assets of the business. Proprietary ratio is a type of solvency ratio that determines the amount or contribution of shareholders (i.e., proprietors or owners) towards the total assets (usually total tangible assets) of an entity. Proprietary ratio (also known as Equity Ratio or Net worth to total assets or shareholder equity to total equity). Establishes relationship between proprietor’s funds to total resources of the unit.

Solvency ratios are those ratios that measure an enterprise’s capability to meet its long-term obligations. Such measures are made using parameters, like the value of long-term debt, the assets available within the organisation, the funds invested in the firm, etc. Thus, shareholders have contributed 40% of all funds used in the business, with creditors contributing the remaining 60% of funds.

For example, off-balance sheet debts may be overlooked during evaluation, leading to an inflated value of this ratio and a false interpretation of the company’s financial position. Additionally, a company’s equity and debt proportions can vary significantly depending on its stage in the business life cycle. While a high proprietary ratio may be attractive for an early-stage startup, the company may have limited earning potential and require substantial investment to grow. However, the ideal ratio can vary significantly depending on the industry and the specific business model of the company. Some companies are more capital-intensive and may require more debt financing, leading to a lower Proprietary Ratio.