This approach helps in identifying inefficiencies and areas for cost reduction, ultimately leading to more accurate overhead allocation. If the company booked $4,000 of estimated overhead at the beginning of the quarter, it would have to reverse the overapplied overhead, so estimated overhead booked matches the actual overhead incurred for the period. On the other hand, the underapplied overhead is the result of the applied manufacturing overhead cost is less than the actual overhead cost that incurs during the accounting period. As you’ve learned, the actual overhead incurred during the year is rarely equal to the amount that was applied to the individual jobs.

Link to Learning

For instance, an inflated gross profit margin might suggest higher operational efficiency than what is actually the case, potentially misleading investors and management. For example, based on estimation, we credit $10,000 into the manufacturing overhead account to assign the overhead cost to the work in process. However, the actual overhead cost which is debited to the manufacturing overhead account is only $9,500. However, during the course of the year, production is more efficient than expected, and actual overhead costs only total $950,000.

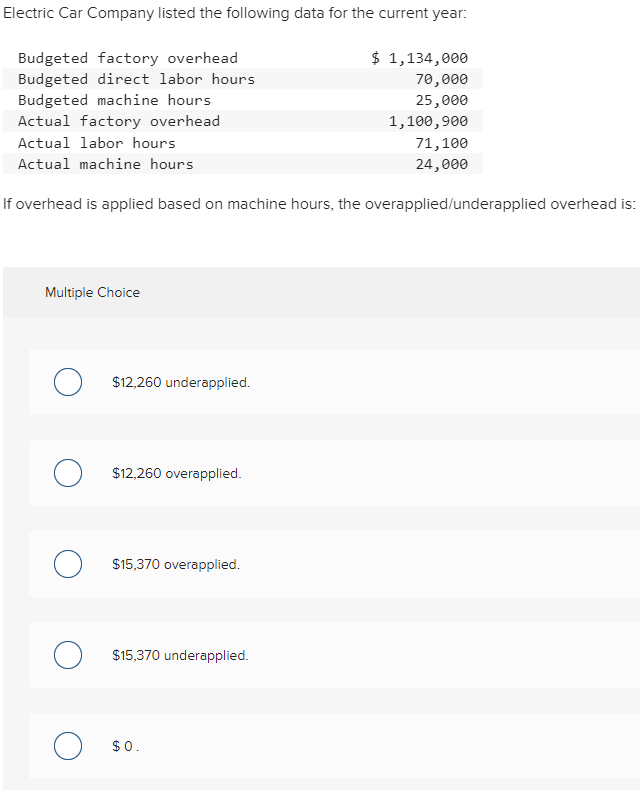

User account menu

On average, however, the amount of overhead applied should approximately match the actual amount of overhead incurred. Depending on their production process, companies may express these costs as a rate per hour of machine time, a rate per hour of worker time or a per-unit cost, for example. Analyzing underapplied overhead takes on greater significance for certain businesses such as manufacturing. Often as part of standard financial planning and analysis (FP&A) activities, careful review on underapplied overhead can point to meaningful changes in operational and financial conditions. These can be useful in assessing capital budgeting decisions and the allocation of limited resources from time, money, and human capital.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- Effective management of overapplied overhead requires a combination of proactive planning and continuous monitoring.

- If the amount of overapplied overhead is significant, it may be spread out across various inventory accounts and cost of goods sold in proportion to the overhead applied during the period.

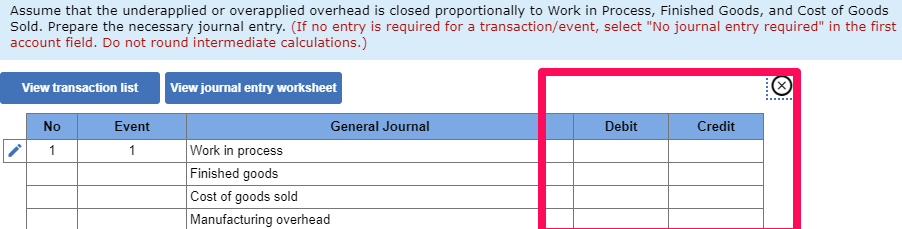

Journal entry for overapplied overhead

Such discrepancies can complicate financial analysis and decision-making processes, particularly when it comes to securing financing or evaluating the company’s liquidity. The company can make the journal entry for overapplied overhead by debiting the manufacturing overhead account and crediting the cost of goods sold account at the period end adjusting entry. Overapplied overhead occurs when expenses incurred are actually less than what a company accounts for in its budget. This means that a company comes in under budget and achieves a lower amount of overhead costs during the accounting period.

What is Overapplied Overhead?

That method will not only allocate the overhead to the cost of goods sold but also to the work in process inventory account and the finished goods inventory account. Effective management of overapplied overhead requires a combination of proactive planning and continuous monitoring. One strategy is to refine the predetermined overhead rate by using more accurate and dynamic allocation bases. For example, activity-based costing (ABC) can provide a more precise method of allocating overhead by linking costs to specific activities and cost drivers.

For example, the actual overhead rate for a company is $10 an hour, Therefore, actual overhead is $10,000 by the equation $10 x 1,000 hours. When underapplied overhead appears on financial statements, it is generally not considered a negative event. Rather, analysts and interested managers look for patterns that may point to changes in the business environment or economic cycle. Should unfavorable payback period formula financial calculator variance or outcomes arise—because not enough product was produced to absorb all overhead costs incurred—managers will first look for viable reasons. These may be explained by expected hiccups in production, business, or seasonal variation. It is useful to note that some companies may use the more accurate method, but more time-consuming, to reconcile the underapplied or overapplied overhead.

This ensures that the inventory valuations on the balance sheet are accurate, reflecting the true cost of production. Once the period concludes, actual overhead costs and actual activity levels are recorded. The next step involves comparing the allocated overhead, calculated using the predetermined rate, to the actual overhead incurred. If the allocated overhead exceeds the actual overhead, the difference is termed overapplied overhead. For instance, if a company estimated $100,000 in overhead costs but only incurred $90,000, and allocated $95,000 based on the predetermined rate, the overapplied overhead would be $5,000.

Depending on materiality, overapplied overhead is either allocated between ending inventory and cost of goods sold or just written off to cost of goods sold. Subtract the budgeted overhead costs from the actual overhead costs to determine the applied overhead. Another significant implication is the need for continuous monitoring and variance analysis. Regularly comparing actual overhead costs to allocated amounts allows for timely identification of discrepancies. This proactive approach helps in making necessary adjustments before the end of the accounting period, thereby minimizing the impact on financial statements.