Taxpayers can also use “write-offs” to reduce their personal taxable income, but this isn’t the same thing. Another example of a writeoff is a building destroyed by a storm. The company will write-off or remove the building from the books and report a casualty loss from the storm. Sometimes companies will get reimbursements from insurance companies to offset the corresponding casualty loss. Either way, these assets are removed from the books because they are no longer in existence and no longer valid.

Analysis: Credit Suisse rescue presents ‘buyer beware’ moment for … – Reuters

Analysis: Credit Suisse rescue presents ‘buyer beware’ moment for ….

Posted: Mon, 20 Mar 2023 07:00:00 GMT [source]

Bad debt is an account receivable for which the business will no longer receive the payment. In simple words, a customer who owes money to the business will either deliberately not pay the money to the business or is in a position where he/she is unable to pay the sum. The business waits for some time and rather than keeping this receivable in its books decides finally to write off the receivables. There are generally two methods to write it off which are direct write off and the allowance method. Similarly, banks write off bad debt that is declared non collectable (such as a loan on a defunct business, or a credit card due that is in default), removing it from their balance sheets.

Debt write-down by a bank is not debt forgiveness

For example, if you get a ₹1,50,000 tax allowance but only owe ₹1,30,000 in taxes, the additional ₹20,000 will not be refunded. Tax credits, on either side, are a rupee-for-rupee reduction in taxes. Whereas a deduction is valued at a proportion of your taxable income, somewhere between 25% and 50%, tax credits are a straightforward tax decrease. If you had been to obtain a reward of ₹10,000, the refund would be worth ₹10,000 to you. Write-downs and write-offs are predominantly performed by businesses.

Enterprises trying to account for overdue loan commitments, overdue invoices, or expenditures on held goods use the terminology metaphorically. Write-offs, on either hand, assist in reducing a firm’s annual tax burden. Units are expected to include accounts receivable write-offs as part of the internal control initiative and include the unit-specific process and materiality threshold.

Write Off in Accounting

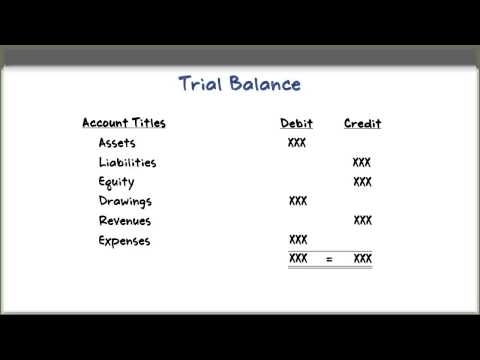

Generally, on the balance sheet, this will involve a debit to an unpaid receivables account as a liability and a credit to accounts receivable. The direct write-off method takes place after the account receivable was recorded. You must credit the accounts receivable and debit the bad debts expense to write it off. A write off occurs upon the realization that an asset no longer can be converted into cash, can provide no further use to a business, or has no market value.

- In absolute terms, SBI’s write-offs jumped almost four times from Rs 5,594 crore in 2012–13 to Rs 21,313 crore in 2014–15.

- Bad debt can be harmful to your business, especially if it happens frequently.

- Write off typically means reducing the value of an asset and on a parallel note debiting the liabilities account in the books of account.

You can’t always control bad debts, but you can work toward making sure they happen less frequently by pursuing payment. When money owed to you becomes a bad debt, you need to write it off. Writing it off means adjusting your books to represent the real amounts of your current accounts. For example, an account receivable will be removed or written off if the customer is not able to pay the amount owed to the company. While taking advantage of tax incentives may result in a larger return, some incentives are non-refundable. This implies that even if the deduction lowers your tax burden to a negative figure, the balance cannot be utilised to boost your tax return.

write sb/sth off

Banks prefer to never have to write off bad debt since their loan portfolios are their primary assets and source of future revenue. Banks use write-offs, which are sometimes called “charge-offs,” gross profit vs operating income chron.com to remove loans from their balance sheets and reduce their overall tax liability. With the allowance method, you predict that you won’t receive payment for credit sales from all your customers.

What Is an Impaired Asset? – The Motley Fool

What Is an Impaired Asset?.

Posted: Tue, 08 Aug 2023 19:34:15 GMT [source]

Deductions reduce the adjusted gross income applied to a corresponding tax rate. Tax credits may also be referred to as a type of write-off because they are applied to taxes owed, lowering the overall tax bill directly. The IRS allows businesses to write off a broad range of expenses that comprehensively reduce taxable profits.

Write-Offs and Write-Downs: The Main Differences

The two generally practiced methods in business accounting for implementing write off to assets are the direct write off method and the allowance method. The journal entries to be used for each of the methods will differ depending on the scenario. A bad debt write-off can occur when a customer who has purchased a product or service on credit is deemed to have defaulted and doesn’t pay. The accounts receivable on the company’s balance sheet is written off by the amount of the bad debt, which effectively reduces the accounts receivable balance by the amount of the write-off. A business may need to take a write-off after determining a customer is not going to pay their bill.

The first way is to write off the asset as a loss on the company’s income statement. The second way is to write off the asset as a reduction to the company’s equity. Another example can be a business that has suffered a loss due to one of its storage units getting destroyed due to a natural calamity. The business in such a case will write off the building from its books and will account for it as a casualty loss.

He is the sole author of all the materials on AccountingCoach.com. You mustn’t deduct the expense from your first line if you’re using a telephone at home or using it purely for business. The expense of a second landline dedicated to your business, on the other hand, is reimbursed.

As a result, you debit bad debts expense and credit allowance for doubtful accounts. When there is a bad debt, you will credit accounts receivable and debit allowance for doubtful accounts. The Internal Revenue Service (IRS) allows individuals to claim a standard deduction on their income tax return and also itemize deductions if they exceed that level.

Banking

Individuals can also itemize deductions if they exceed the standard deduction level. Financial institutions use write-off accounts when they have exhausted all methods of collection action. Write-offs may be tracked closely with an institution’s loan loss reserves, which is another type of non-cash account that manages expectations for losses on unpaid debts. Loan loss reserves work as a projection for unpaid debts, while write-offs are a final action. Organisations and individuals can use a tax deduction to reduce their tax liability. A write-off is extremely helpful for you as a taxpayer since it lowers your tax liability.