Journal entries are transferred to the general ledger when they’re posted to an account, such as accounts receivable. The trial balance is like a snapshot of your business’s financial health at a specific moment. It lists the current balances in all your general ledger accounts. In this case, we can see the snapshot of the opening trial balance below.

- To update the balance in Retained Earnings, we must transfer net income and dividends/distributions to the account.

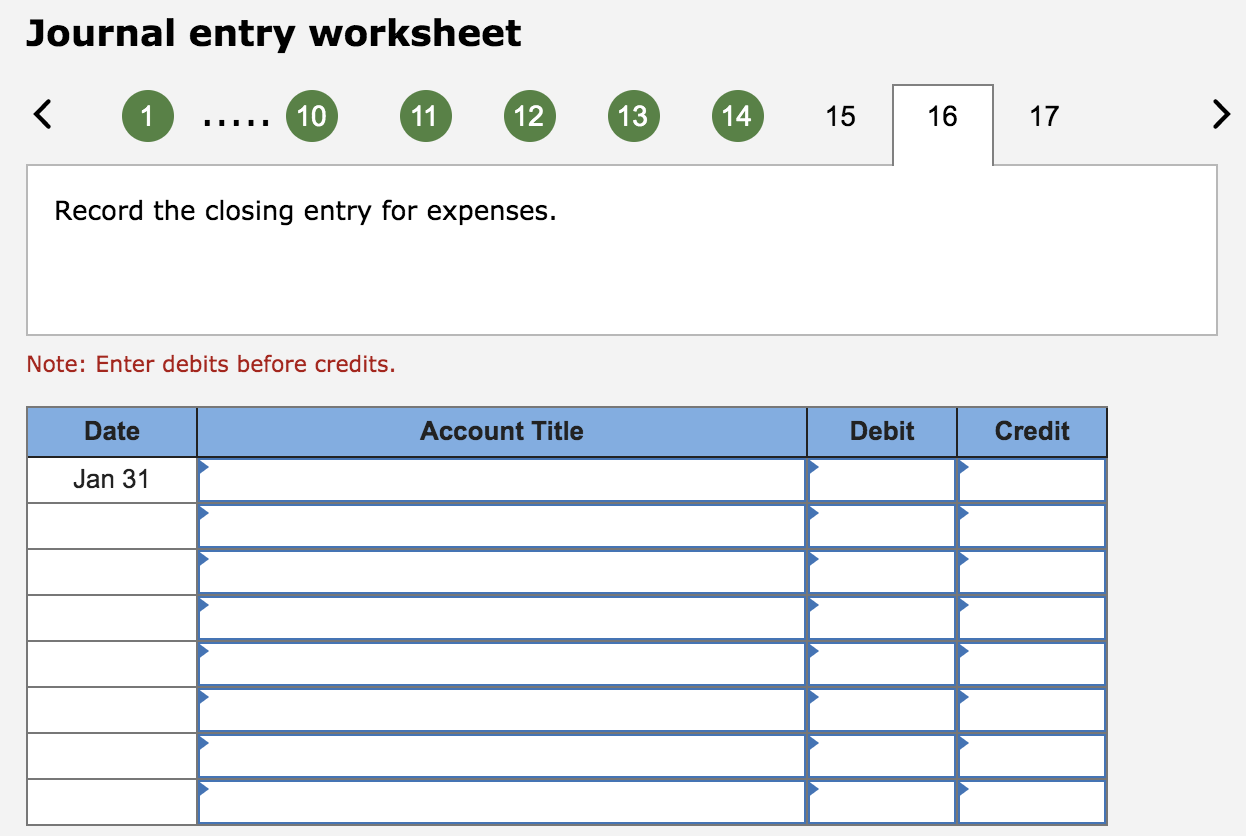

- The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data.

- Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries.

How Highradius Can Help You Streamline Your Accounting Management

The first is to close all of the temporary accounts in order to start with zero balances for the next year. The second is to update the balance in Retained Earnings to agree to the Statement of Retained Earnings. If expenses were greater than revenue, we would have net loss.

The Purpose of Closing Entries

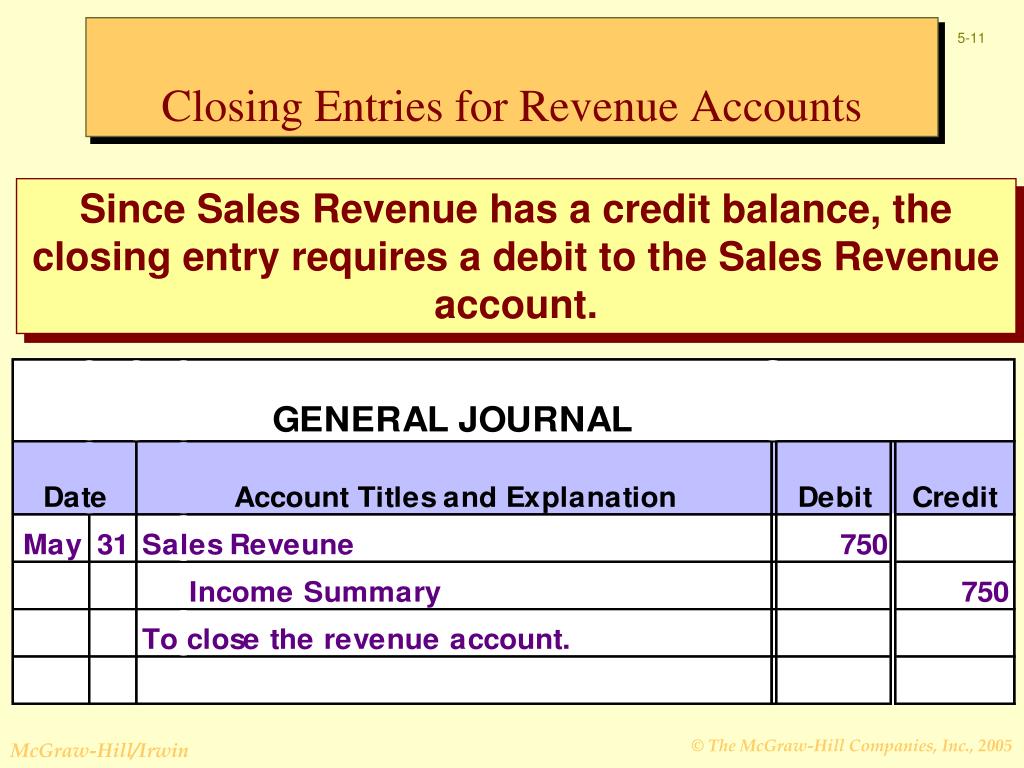

Notice that revenues, expenses, dividends, and income summaryall have zero balances. The post-closing T-accounts will be transferred to thepost-closing trial balance, which is step 9 in the accountingcycle. The first entry requires revenue accounts close to the IncomeSummary account. The first entrycloses revenue accounts to the Income Summary account. The secondentry closes expense accounts to the Income Summary account. Having a zero balance in theseaccounts is important so a company can compare performance acrossperiods, particularly with income.

Permanent versus Temporary Accounts

In other words, the closing entry is a method of making repayments on all the costs incurred within a given financial year. To complete, this method involves transfer of funds from revenue-generating accounts such as wages payable and interest receivable to an intermediary account known as income summary. Therefore, we can calculate either profit review of the independence and effectiveness of the operations evaluation department margin for this company or how much it lost over the year. Closing entries are journal entries you make at the end of an accounting cycle that movie temporary account balances to permanent entries on your company’s balance sheet. When doing closing entries, try to remember why you are doing them and connect them to the financial statements.

Then, transfer the balance of the income summary account to the retained earnings account. Finally, transfer any dividends to the retained earnings account. Now that all the temporary accounts are closed, the income summary account should have a balance equal to the net income shown on Paul’s income statement. Now Paul must close the income summary account to retained earnings in the next step of the closing entries.

Use of an Income Summary Account

The total of the income summary account after the all temporary accounts have been close should be equal to the net income for the period. Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. For example, the revenues account records the amount of revenues earned during an accounting period—not during the life of the company. We don’t want the 2015 revenue account to show 2014 revenue numbers. Income summary effectively collects NI for the period and distributes the amount to be retained into retained earnings.

Answer the following questions on closing entries and rate your confidence to check your answer. Businesses often use professional bookkeeping services to ensure they are on track financially, are tax-season ready, and are able to continue to grow and thrive. Get started here if you want to speak to a professional about your business cash flow. Most small companies close their books monthly, though some only do so at year’s end. That means you need to choose what entries you want to include. For example, you could choose all entries in 2025, or it could be for the month of January 2025 only.

If we do not close out the balances in the revenue and expense accounts, these accounts would continue to contain the revenue and expense balances from previous years and would violate the periodicity principle. Permanent accounts, such as asset, liability, and equity accounts, remain unaffected by closing entries. In short, we can clear all temporary accounts to retained earnings with a single closing entry. By debiting the revenue account and crediting the dividend and expense accounts, the balance of $3,450,000 is credited to retained earnings. The income summary account is a temporary account solely for posting entries during the closing process.

To update the balance in Retained Earnings, we must transfer net income and dividends/distributions to the account. By closing revenue, expense and dividend/distribution accounts, we get the desired balance in Retained Earnings. This means thatit is not an asset, liability, stockholders’ equity, revenue, orexpense account. The closing entry entails debiting income summary and crediting retained earnings when a company’s revenues are greater than its expenses. The income summary account must be credited and retained earnings reduced through a debit in the event of a loss for the period. The four closing entries are, generally speaking, revenue accounts to income summary, expense accounts to income summary, income summary to retained earnings, and dividend accounts to retained earnings.

Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet. Another essential component of the Highradius suite is the Journal Entry Management module. This module automates the creation and management of journal entries, ensuring consistency and accuracy in your financial statements. Organizations can achieve up to 95% journal posting automation with a pre-filled template, reducing errors and discrepancies and providing a reliable view of financial data. However, some corporations use a temporary clearing account for dividends declared (let’s use “Dividends”).