A price-to-book ratio under 1.0 typically indicates an undervalued stock, although some value investors may set different thresholds such as less than 3.0. For example, let’s suppose that a company has a total asset balance of $60mm and total liabilities of $40mm. At times companies buy back some floating shares as part of corporate strategy. These repurchased shares are not canceled but rather held by the company as treasury shares in their books. Common Stock is the equity capital at the par value of the shares, and the additional paid-in capital is the excess capital over and above the par value. The ratio may not serve as a valid valuation basis when comparing companies from different sectors and industries because companies in other industries may record their assets differently.

Deceptive Depreciation and Book Value

Outdated equipment may still add to book value, whereas appreciation in property may not be included. If you are going to invest based on book value, you have to find out the real state of those assets. That said, looking deeper into book value will give you a better understanding of the company. In some cases, a company will use excess earnings to update equipment rather than pay out dividends or expand operations. While this dip in earnings may drop the value of the company in the short term, it creates long-term book value because the company’s equipment is worth more and the costs have already been discounted. An investor looking to make a book value play has to be aware of any claims on the assets, especially if the company is a bankruptcy candidate.

Example of BVPS

If the book value per share is higher than its market value per share then it can indicate an undervalued stock. If the book value per share is lower than its market value per share, it can indicate an overpriced, or overvalued stock. When the market value is near or less than the book value, loan note payable borrow accrued interest and repay the P/B ratio will be 1 or less, signaling that the stock may be undervalued. An undervalued stock can be a great bargain, particularly if company fundamentals are strong and the investor has a long timeline. Investors commonly analyze book value in the context of the company’s market value.

- As noted above, another way to calculate book value is to subtract a business’ total liabilities from its total assets.

- Therefore, book value is roughly equal to the amount stockholders would receive if they decided to liquidate the company.

- This differs from the book value for investors because it is only used internally for managerial accounting purposes.

- Investors who rely heavily on book value analysis are typically looking for good stocks that are temporarily underpriced by the investment community.

- This means that, in the worst-case scenario of bankruptcy, the company’s assets will be sold off and the investor will still make a profit.

Balance Sheet Assumptions

Additionally, the company had accumulated minority interest of $6.49 billion. After subtracting that, the net book value or shareholders’ equity was about $84.07 billion for Walmart during the given period. Suppose that XYZ Company has total assets of $100 million and total liabilities of $80 million. If the company sold its assets and paid its liabilities, the net worth of the business would be $20 million.

Free Financial Modeling Lessons

Book value is the value of a company’s total assets minus its total liabilities. It may not include intangible assets such as patents, intellectual property, brand value, and goodwill. It also may not fully account for workers’ skills, human capital, and future profits and growth. If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases. If, for example, the company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, common equity increases along with BVPS. On the other hand, if XYZ uses $300,000 of the earnings to reduce liabilities, common equity also increases.

This is because the share price is a demand-driven value that’s influenced by the investment community’s opinion on the company’s earnings potential. If a company consistently performs well from a profitability standpoint and decides to reinvest in its current growth, the retained earnings balance will increasingly accumulate over time. As implied by the name, the “book” value of equity represents the value of a company’s equity according to its books (i.e. the company’s financial statements, and in particular, the balance sheet).

For example, a company has a P/B of one when the book valuation and market valuation are equal. The next day, the market price drops, so the P/B ratio becomes less than one. That means the market valuation is less than the book valuation, so the market might undervalue the stock.

It implies that investors can recover more money if the company goes out of business. The examples given above should make it clear that book and market values are very different. Many investors and traders use both book and market values to make decisions. There are three different scenarios possible when comparing the book valuation to the market value of a company.

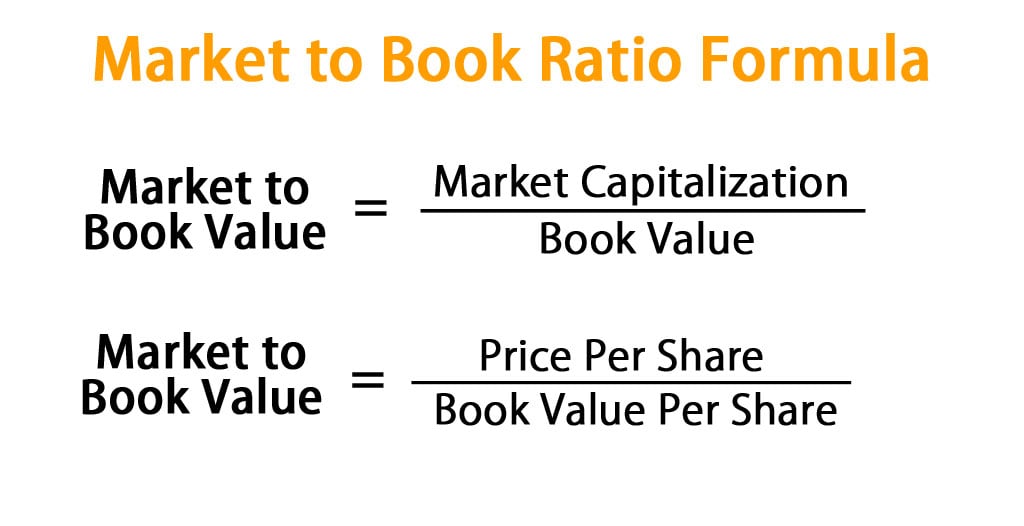

It is a dollar amount computed based on the current market price of the company’s shares. When the market value is greater than the book value, the stock market is assigning a higher value to the company due to the earnings power of the company’s assets. In comparison, the market value of equity refers to how much the common equity of a company is worth according to the latest prices paid for each common share and the total number of shares outstanding. The figure that represents book value is the sum of all of the line item amounts in the shareholders’ equity section on a company’s balance sheet. As noted above, another way to calculate book value is to subtract a business’ total liabilities from its total assets.