Repeat the entire process and you’ll find that a new LIFO layer of $100 is added. The inventory layers for 2020 and 2021 then become $0 and $100, respectively. The decision to use Dollar Value LIFO or any other inventory management method should be made considering a company’s specific circumstances and requirements. Just like any other inventory valuation method, the Dollar Value LIFO inventory method has its unique strengths and limitations, and it’s important to understand these. A layer in Dollar Value LIFO is a level of inventory that has been added to the base stock.

Interpretation of Dollar Value LIFO Formula

The diversity in products in inventory pools allows this industry to smoothly transition from one year’s collection to another, without dealing with eroding layers. It helps the companies to account for the impact of inflation on their financial reporting. The adoption of Dollar-Value LIFO can lead to significant changes in a company’s financial statements, particularly in the balance sheet and income statement. By valuing inventory at the most recent costs, this method often results in lower ending inventory values compared to other inventory valuation methods like FIFO (First-In, First-Out).

Dollar Value LIFO – Key takeaways

However, since costs do change over time, the dollar-value LIFO presents the data in a manner that shows an increased cost of goods sold (COGS) when prices are rising, and a resulting lower net income. When prices are decreasing, dollar-value LIFO will show a decreased COGS and a higher net income. Dollar value LIFO can help reduce a company’s taxes (assuming prices are rising), but can also show a lower net income on shareholder reports.

Key Concepts of Dollar Value LIFO

The dollar-value LIFO method is an inventory accounting approach where the latest inventory layers are assumed to be sold first, reflecting current costs in the cost of goods sold (COGS). This method is particularly beneficial for managing taxable income during inflation, as it adjusts inventory values to account for price changes, both inflation and deflation. If inflation and other economic factors (such as supply and demand) were not an issue, dollar-value and non-dollar-value accounting methods would have the same results.

Advantages of the Dollar Value LIFO Inventory Method

This tax deferral can be particularly advantageous in times of inflation, as it allows businesses to retain more cash for operations and investments. Under standard LIFO, you must track your inventory by units, even if you combine similar units into pools. This requires you to track the cost of all purchases and keep records on how you use up your inventory pools through sales. If you adopt the DVL method, you make a physical count of ending inventory and apply the proper DVL cost. The DVL method allows you to determine the proper cost without referring to any flow assumptions for inventory units. In other words, you don’t have to worry about applying costs in LIFO sequence to the units you sell during the year.

For instance, if in year 1, you have 10 units of product A and in year 2, you add 5 more units, then those 5 units form a layer over the base stock of 10 units. The Dollar Value LIFO (Last-In, First-Out) is a business accounting technique used to manage inventory and calculate the cost of goods sold. It may seem complex at first, but as you delve about form 7200 advance payment of employer credits due to covid deeper, you’ll appreciate its utility and elegance. An eligible small business may elect to use the simplified dollar-value method of pricing inventories for purposes of the LIFO method. Vaia is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels.

- This depth of knowledge is not just beneficial for academic purposes, but also proves advantageous in real-world business scenarios, aiding better decisions regarding inventory control and financial accounting.

- Additionally, companies should avoid creating unnecessary inventory pools to prevent increased complexity and costs.

- However, it can be more complex to implement than other inventory valuation methods.

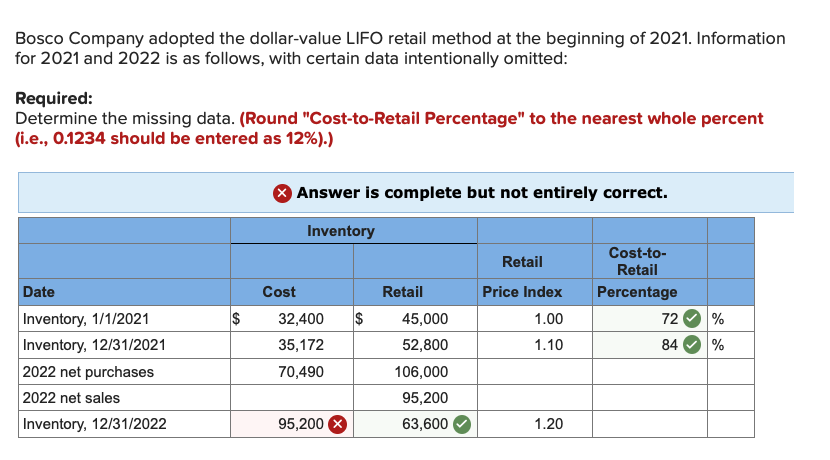

- So, under the Dollar-Value LIFO method, your inventory at the end of 2022 would be valued at $1,360.

- The focus in this calculation is on dollar amounts, rather than units of inventory.

In an inflationary environment, it can more closely track the dollar value effect of cost of goods sold (COGS) and the resulting effect on net income than counting the inventory items in terms of units. Like specific goods pooled LIFO approach, Dollar-value LIFO method is also used to alleviate the problems of LIFO liquidation. Under this method, goods are combined into pools and all increases and decreases in a pool are measured in terms of total dollar value.

Only if such information is impossible to locate can the current cost also be considered the base year cost. Specific Identification is a method that assigns actual costs to individual inventory items. This approach is highly accurate and is often used for high-value or unique items, such as luxury goods or custom machinery.

You group DVL pools by year, not unit, so you don’t create new pools when you replace units with different ones. By maintaining the older layers, you match your COGS to the most recent purchase prices, which is the whole point of LIFO. This method assumes that the last goods added to inventory are the first ones to be sold. New layer is added ONLY if ending inventory at base-year prices is more than respective year’s beginning inventory at base-year prices. Once the actual increase is computed, it is then adjusted for current year prices and then we can know the total value of ending inventory under dollar-value LIFO.

It’s the year when the first inventory count is done and the first dollar value is deemed. “(1) In general.-The amendments made by this section [amending this section] shall apply to taxable years beginning after December 31, 1986. Unless the taxpayer secures the consent of the Secretary to the revocation of such election.