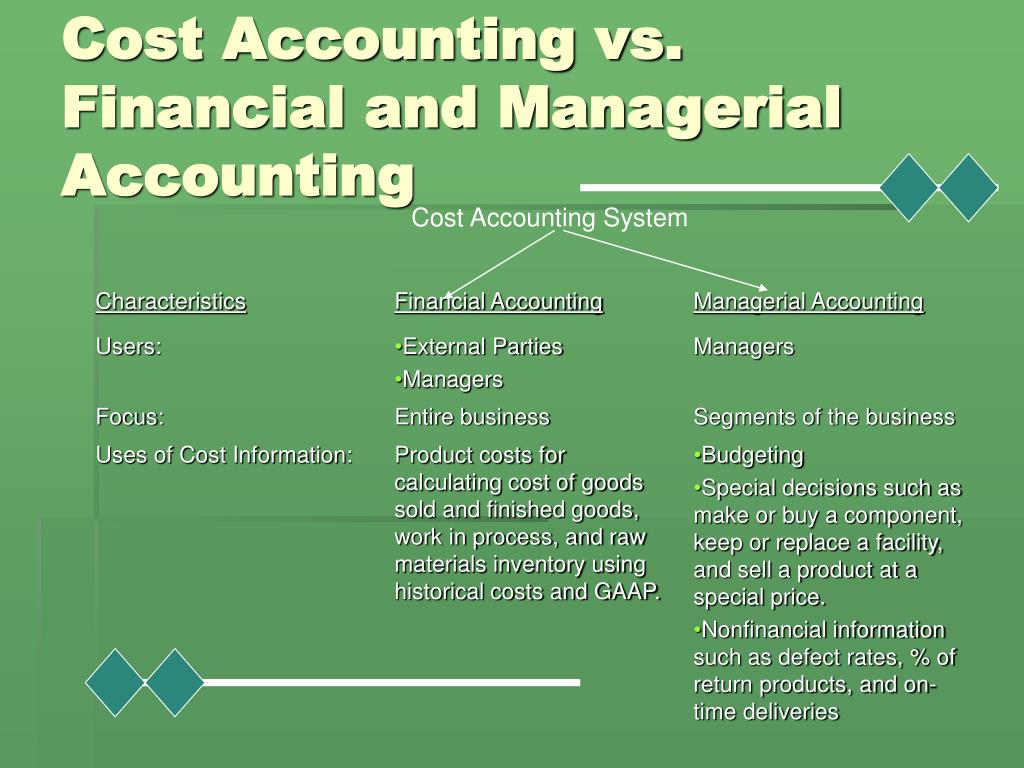

All publicly held companies are required to complete their financial statements in accordance with GAAP as a requisite for maintaining their publicly traded status. Most other companies in the U.S. conform to GAAP in order to meet debt covenants often required by financial institutions offering lines of credit. Managerial accounting differs from financial accounting because the intended purpose of managerial accounting is to assist users internal to the company in making well-informed business decisions.

Get A Clear Picture With Managerial And Financial Accounting

These statements are important for investors and creditors to assess the financial health of the company and determine whether it is profitable and financially stable. This statement shows a company’s assets, liabilities, and equity at a specific point in time. External users such as financial institutions and investors use the balance sheet to evaluate a company’s financial health and stability. Managerial accounting, also known as management accounting, is the process of generating financial information for internal use by management. It is a detailed and comprehensive form of accounting that involves analyzing and interpreting financial data to assist with decision-making, planning, and control within a business organization. One major difference between financial accounting and managerial accounting is the audience for which the information is intended.

To Ensure One Vote Per Person, Please Include the Following Info

Financial accountants supervise tax payments, maintain the company’s financial records and analyze financial data to forecast market trends. Managerial accounting is concerned with providing information to managers i.e. people inside an organization who direct and control its operations. In contrast, financial accounting is concerned with providing information to stockholders, creditors, and others who are outside an organization. Managerial accounting provides the essential data with which organizations are actually run. Financial accounting provides the scorecard by which a company’s past performance is judged.

The Differences Between Finance and Accounting

Product costing deals with determining the total costs involved in the production of a good or service. Costs may be broken down into subcategories, such as variable, fixed, direct, or indirect costs. Cost accounting is used to measure and identify those costs, in addition to assigning overhead to each type of product created by the company. Use Wafeq to keep all your expenses and revenues on track, manage payroll and inventory, plus generate over 30 financial reports from one place.

A managerial accountant may run different scenarios by the department manager depicting the cash outlay required to purchase outright upfront versus the cash outlay over time with a loan at various interest rates. It gives you insights into different aspects of your business, such as cost behavior, profitability, and cash flow, which can help in analyzing how different decisions might affect your financial health. For a startup, this means determining whether to enter a new market, launch a new product, or cut costs in a specific area. Without this information, you are likely to make decisions based on incomplete or outdated data, which increases the chances of errors. No, managerial accounting does not follow GAAP guidelines because it focuses on preparing internal reports and information for the internal management’s use and does not comply with external reporting standards.

Nature of Reports

Both financial accounting and management accounting are considered to be two of the four most important subfields within the subject of accounting (e.g., tax accounting and auditing are others). Each system of accounting (managerial accounting vs. financial accounting) requires a different level of training and certification. Managerial accounting deals with budgets and forecasts and is geared more toward the future. Yes, it can provide insight into the present situation of your business, but it rarely delves into the past. Financial accounting, on the other hand, is strictly regulated by a vast number of basic, intermediate, and advanced accounting standards.

- Financial accounting reports are developed from the basic accounting system, which is designed to highlight data about completed transactions.

- In financial accounting, budgets are created based on historical data and are used to forecast future revenue and expenses.

- For example, you might want to bury lower bonuses in an overall number for expenses to avoid angering midlevel to lower-level employees who peruse the report.

- In contrast, financial accounting reports are highly regulated, especially the income statement, balance sheet, and cash flow statement.

- These reports must comply with GAAP and be audited by a certified public accountant (CPA).

- Appropriately managing accounts receivable (AR) can have positive effects on a company’s bottom line.

When managerial accounting focuses on internal consumption, there’s no need to follow a set of standards, whereas financial accounting is meant for internal and external consumption. Therefore, it must comply with a set of accounting standards, such what is the indexation definition as general principles, liabilities, revenue, equity, etc. Conventionally, financial accounting aims to ascertain information regarding the performance, profitability and position of the organization based on the business activities undertaken.

Through managerial accounting, startups can monitor their key performance indicators (KPIs) that are critical in scaling operations, such as cost of goods sold, overhead expenses, and gross margins. With these metrics, startups can understand the financial consequences of scaling decisions such as expanding into new markets, increasing production, or hiring additional staff. Financial accounting involves the analysis of business transactions, reporting to external parties, and preparing financial statements for public use. Managerial accounting is a subset of financial accounting that focuses on providing information to internal stakeholders. The information provided by managerial accounting is used by financial accounting to prepare financial statements.