If you had taken care of the bed bugs right away, they wouldn’t have been able to multiply at such a rate. Calculate percentage additions and deductions with our handy calculator. This article about the compound interest formula has expanded and evolved based upon your requests for adapted formulae andexamples. Our investment balance after 10 years therefore works out at $20,720.91. Our partners cannot pay us to guarantee favorable reviews of their products or services. Interest Earned – How much interest was earned over the number of years to grow.

Simple vs. compound interest

- In reality, investment returns will vary year to year and even day to day.

- For example, $100 with a fixed rate of return of 8% will take approximately nine (72 / 8) years to grow to $200.

- You can even see how much you’d earn if you kept saving at that rate, or how much you’d be charged in compound interest if you wanted to pay off your debt.

- In our example, the accumulated interest is $218.99, which is our future value of $1,218.99 minus our principal of $1,000 (remember that this interest is the sum of all the interest payments each year).

- The compound interest calculation accounts for interest you earn over time and adds it back into the amount being invested or saved.

- As always, we recommend speaking to a qualified financial advisor for advice.

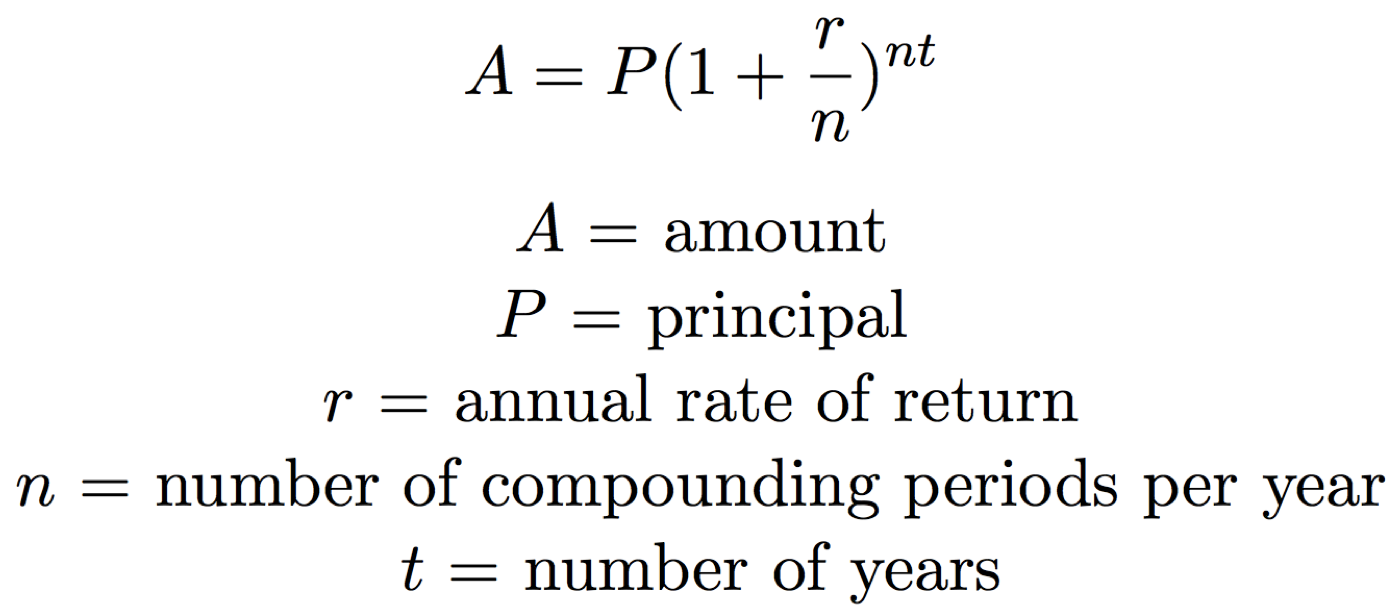

Use this calculator to easily calculate the compound interest and the total future value of a deposit based on an initial principal. The Rule of 72 is a shortcut to determine how long it will take for a specific amount of money to double given a fixed return rate that compounds annually. One can use it for any investment as long as it involves a fixed rate with compound interest in a reasonable range. Simply divide the number 72 by the annual rate of return to determine how many years it will take to double. It’s important to remember that these example calculations assume a fixed percentage yearly interest rate.

Set the Number of Years of Growth

This course will show you how to calculate your retirement number accurately the very first time – with confidence – using little-known tricks and tips that make the process easy. Note that when doing calculations, you must be very careful with your rounding. For standard calculations, six digits after the decimal point should be enough. Read on to learn more about the magic of compound interest and how it’s calculated. However, certain societies did not grant the same legality to compound interest, which they labeled usury.

How to Derive A = Pert the Continuous Compound Interest Formula

The longer the amount of time, or the steeper the hill, the larger the snowball or sum of money will grow. Anyone who wants to estimate compound interest in their head may find the rule of 72 very useful. Not for exact calculations as given by financial calculators, but to get ideas for ballpark figures.

To calculate total principal, add the initial value to the annual contribution times the number of years you contributed. If there are no contributions, then the total principal is equal to the initial value. If you want to find the time it will take to double an investment using compound interest then you can use the Rule of 72. The Rule of 72 provides an approximation of the time to double by dividing 72 by the annual interest rate.

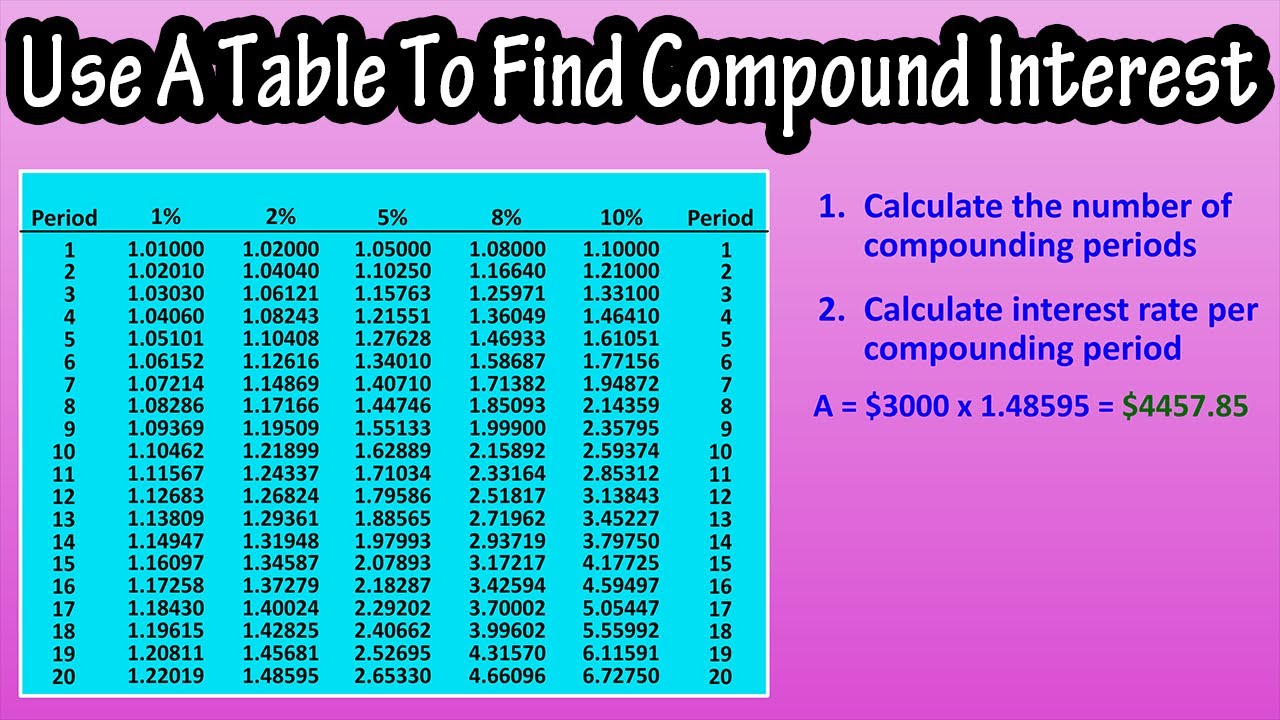

As an example, $1000 with a fixed rate of return of 7% will take around 10 (72 divided by 9) years to become $2000. When the returns you earn are invested in the market, those returns compound over time in the same way that interest compounds. Compound interest is the interest you earn on your original money and on the interest that keeps accumulating. Total Deposits gross pay versus net pay – The total number of deposits made into the investment over the number of years to grow. Compound interest tables were used every day before the era of calculators, personal computers, spreadsheets, and unbelievable solutions provided by Omni Calculator

Beginning Account Balance – The money you already have saved that will be applied toward your savings goal. By using the Compound Interest Calculator, you can compare two completely different investments. However, it is important to understand the effects of changing just one variable. You only get one chance to retire, and the stakes are too high to risk getting it wrong.

Hence, if a two-year savings account containing $1,000 pays a 6% interest rate compounded daily, it will grow to $1,127.49 at the end of two years. The TWR figure represents the cumulative growth rate of your investment. When interest compounding takes place, the effective annual rate becomes higher than the nominal annual interest rate.