As you can see, the accumulated depreciation account has a credit balance that increases over time. This is subtracted from the asset’s original cost to give you the net book value, which more accurately reflects the current value of the asset. Accumulated depreciation is recorded in a contra account, meaning it has a credit balance, which reduces the gross amount of the fixed asset. Depreciation expenses a portion of the cost of the asset in the year it was purchased and each year for the rest of the asset’s useful life. Accumulated depreciation allows investors and analysts to see how much of a fixed asset’s cost has been depreciated.

What Are Depreciation Expenses?

It is calculated by summing up the depreciation expense amounts for each year up to that point. Since accumulated depreciation is a credit entry, the balance sheet can show the cost of the fixed asset as well as how much has been depreciated. From there, we can calculate the net book value of the asset, which in this example is $400,000. Accumulated depreciation is dependent on salvage value; salvage value is determined as the amount a company may expect to receive in exchange for selling an asset at the end of its useful life.

Methods to Calculate Accumulated Depreciation

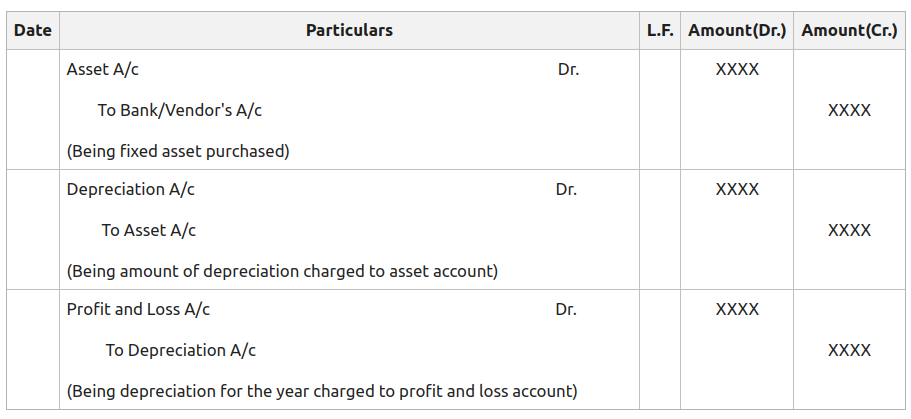

The initial accounting entries for the first payment of the asset are thus a credit to accounts payable and a debit to the fixed asset account. Each year, the depreciation expense account is debited, expensing a portion of the asset for that year, while the accumulated depreciation account is credited for the same amount. Over the years, accumulated depreciation increases as the depreciation expense is charged against the value of the fixed asset.

The Financial Modeling Certification

Various methods, such as straight line, declining balance, sum-of-the-years’ digits, and units of production, are used to calculate depreciation. It is credited each year as the value of the asset is written off and remains on the books, reducing the net value of the asset, until the asset is disposed of or sold. Depreciation expense is considered a non-cash expense because the recurring monthly depreciation entry does not involve a cash transaction.

Related AccountingTools Courses

- Each year, the depreciation expense account is debited, expensing a portion of the asset for that year, while the accumulated depreciation account is credited for the same amount.

- In short, by allowing accumulated depreciation to be recorded as a credit, investors can easily determine the original cost of the fixed asset, how much has been depreciated, and the asset’s net book value.

- Depreciation expense is recorded on the income statement as an expense and reflects the amount of an asset’s value that has been consumed during the year.

- Accumulated depreciation is the cumulative depreciation of an asset that has been recorded.Fixed assets like property, plant, and equipment are long-term assets.

Unlike a normal asset account, a credit to a contra-asset account increases its value while a debit decreases its value. Depreciation expense is recorded on the income statement as an expense or debit, reducing net income. Instead, it’s recorded in a contra asset account as a credit, reducing the value of fixed assets. Depreciation expenses, on the other hand, are the allocated portion of the cost of a company’s fixed assets for a certain period. Depreciation expense is recognized on the income statement as a non-cash expense that reduces the company’s net income or profit.

FAR CPA Practice Questions: Debt Covenant Compliance Calculations

For example, in the second year, current book value would be $50,000 – $10,000, or $40,000. Accumulated depreciation totals depreciation expense since the asset has been in use. Tracking the depreciation expense of an asset is important for reporting purposes because it spreads the cost of the asset over the time it’s in use. For example, Company A buys a company vehicle in Year 1 with a five-year useful life. Since fixed assets have a debit balance on the balance sheet, accumulated depreciation must have a credit balance, in order to properly offset the fixed assets.

Accumulated depreciation is the total depreciation for a fixed asset that has been charged to expense since that asset was acquired and made available for use. The intent behind doing so is to approximately match the revenue or other benefits generated by the asset to its cost over its useful life (known as the matching principle). Depreciation expense is recorded on the income statement as an expense and reflects the amount of an asset’s value that has been consumed during the year. The four methods allowed by generally accepted accounting principles (GAAP) are the aforementioned straight-line, along with declining balance, sum-of-the-years’ digits (SYD), and units of production. Accumulated depreciation is the total amount of an asset’s original cost that has been allocated as a depreciation expense in the years since it was first placed into service.

To put it another way, accumulated depreciation is the total amount of an asset’s cost that has been allocated as depreciation expense since the asset was put into use. If an asset is sold or disposed of, the asset’s accumulated depreciation is “reversed,” or removed from the balance sheet. Because a fixed asset does not hold its value over time (like cash does), it needs the carrying value to be gradually reduced. Depreciation expense gradually writes down the value of a fixed asset so that asset values are appropriately represented on the balance sheet.

However, there are situations when the accumulated depreciation account is debited or eliminated. Depreciation is defined as the expensing of an asset involved in producing revenues throughout its useful life. Depreciation for accounting purposes refers the allocation of the cost of assets to periods in which the assets are used (depreciation with the matching of revenues to expenses principle).

Hence, the credit balance in the account Accumulated Depreciation cannot exceed the debit balance in the related asset account. Depreciation expense is classified as a non-cash expense because the recurring monthly depreciation what does the credit balance in the accumulated depreciation account represent entry does not involve any cash transactions. As a result, the statement of cash flows, prepared using the indirect method, adds back the depreciation expense to calculate the cash flow from operations.