To give you an idea of when it makes sense to undo a bank reconciliation in QuickBooks Online, let’s use the following scenario. Now, open the register for the account you are un-reconciling by hovering over Accounting on the left-side toolbar and then selecting Chart of Accounts. Your clients can also edit individual transactions on a reconciliation whenever they need to. This is only available for accountants who use QuickBooks Online Accountant.

How to Undo a Reconciliation in QuickBooks Desktop?

- After selecting the account, locate and click on the designated ‘Undo’ button within the interface of QuickBooks Online to initiate the reconciliation adjustment process.

- With QuickBooks Online Accountant, users can easily locate and select the specific transaction(s) that require correction, allowing for seamless adjustments without disrupting the overall reconciliation process.

- Upon clicking the ‘Undo’ button, QuickBooks Online will prompt a confirmation dialogue to ensure the intentional initiation of the reconciliation undo process.

- This action will prompt QuickBooks Online to guide you through the necessary steps for unreconciling the selected account, ensuring accuracy and efficiency in your financial records.

Undoing a reconciliation in QuickBooks Online involves a series of steps to ensure the accurate adjustment of previously reconciled transactions and accounts. Undoing a reconciliation in QuickBooks Desktop involves a distinct set of actions and interface navigation to ensure the accurate adjustment of previously reconciled transactions and accounts. This action triggers the ‘Delete Bank Reconciliation’ feature, allowing you to make adjustments and rectify any discrepancies in the reconciled transactions. Once the ‘Delete’ button is clicked, a confirmation prompt appears, ensuring that the user can confirm the deletion before proceeding. It’s crucial to carefully review each transaction, ensuring that the changes made align with the accurate financial data. This meticulous process guarantees that the ongoing reconciliation process maintains integrity and reliability.

As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on temporary and permanent accounts maximizing the benefits of the software. Also, try never to force a reconciliation by posting to the Reconciliation Discrepancies account. Only then should you post to the Reconciliation Discrepancies account. Reconciling your accounts is a critical accounting function in your business and one that should be completed regularly.

Next steps: Fix other reconciliation errors

Backing up your QuickBooks Online company files regularly ensures you can quickly and easily recover data and undo mistakes, big or small. When you need to restore your data in a hurry, automated cloud backup solutions such as Rewind act as an undo button for businesses using QuickBooks Online. When your balance sheet and bank statement don’t match, you’ll have to reconcile your QuickBooks Online transactions before attempting to correct any mistakes. To start the process, you would first need to open QuickBooks and navigate to the Banking menu. From there, you should select Reconcile and then locate the account for which you want to undo the reconciliation.

Click on Transactions in the left navigation menu and then select Chart of accounts. Choose the account and the statement you want to undo reconciliation for, and click View Report. If you’re working with an accounting professional who’s using a QuickBooks Accountant subscription, they’ll have access to a special reconciliation tool which allows them to undo a client’s reconciliation. Make sure your opening balance is correct before checking your beginning balance. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. Our partners cannot pay us to guarantee favorable reviews of their products or services.

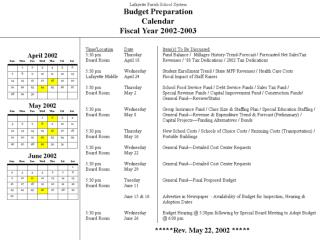

Example of a Bank Reconciliation to Undo in QuickBooks Online

This will let you quickly reference the report as you’re working to undo the reconciliation. This could be a reconciliation you’ve just completed, or it could be a reconciliation from a previously closed month. One of the most common errors with reconciliation is when the bookkeeper incorrectly enters the opening or closing balance.

Fix issues for accounts you’ve reconciled in the past in QuickBooks Online

The two checks that we just unreconciled should be unmarked, and the $325 that we marked as reconciled should have an “R” status. You will, however, want to regularly reconcile any short-term or long-term liability (loan) accounts to make sure the principal due and the interest paid are correctly accounted for in QuickBooks. The process for reconciling these accounts is the same as the process for reconciling a bank or credit card account, and it typically takes only moments to do.

After identifying the account, proceed to click on ‘Delete Bank Reconciliation’ to initiate the unreconcile process. This action will prompt QuickBooks Online to guide you through the necessary steps for unreconciling the selected account, ensuring accuracy and efficiency in your financial records. The feature of ‘Undo Reconciliation’ in QuickBooks Online allows you to rectify any mistaken reconciliations efficiently. Bank Reconciliation in QuickBooks Online enables businesses what is the journal entry for when a business makes a loan to cross-verify their accounting records with bank statements, ensuring that all transactions are accurately reflected. When you reconcile an account, you compare each transaction on your bank statement with transactions entered into QuickBooks.

Now, click on the Reconcile button at the top right corner of the Bank Register screen. Keep in mind, Intuit is continuously making changes to the QuickBooks Online user experience, so the actual appearance of your screen might differ slightly from the screenshots what is the journal entry to record the issuance of common stock shown here. Before you start, you may want to download any attachments tied to the reconciliation. See articles customized for your product and join our large community of QuickBooks users.