Then highlight different categories, and do their percentages. Instead of buying something on the spot, they’ll think through a day, or a few days ahead of how they want to use their money. Let’s face it – even within one classroom of same-aged students, you’re dealing with varying capabilities. of the credit Ask a student volunteer to come up to the class and sort the receipts. I hate to burst your bubble, but there aren’t many (if any) teenage budget calculators out there. Not only that, but when you write down what you plan to spend, you’re much more successful at actually sticking to it.

Understanding Checking vs. Savings Accounts (Plus a Free Slideshow)

The takeaway here is that regularly practicing corporate budgeting exercises will sharpen your financial tools and help you remain responsive to changing economic conditions. If 2020 has taught us anything it’s that we need to stay flexible and ready to make dynamic shifts in our budgets—and we will. A budget should never just be a collection of numbers or money that can be spent, but should reflect your strategic goals. One important budgeting exercise is to begin with the company strategy in mind. Whatever your strategy may be, take a closer look at your budget with that particular strategy at the forefront.

Add your School Information

The Payoff you play as a vlogger that is preparing for a video competition that will change your life! You have to manage your finances as you prepare and expect some unexpected events as you progress in the game. The game takes around 20 minutes to play and allows the players to experience 20 years of investing. The game teaches that index investing always wins, and slow and steady wins the race with investing in stocks which is an important part of any financial education. Students are randomly assigned a career and salary, and must then create their own spending plan around the money they have.

Best Teen Budget Worksheets

Anticipated revenue here is the potential cash inflow for an individual, and the estimated expenditure can be defined as the outflow of the cash for the future. It is the act of balancing one’s expenses with the current income. Budgeting is instrumental for the foundation of any financial plan, and efficiency in financial management behavior is important to make these decisions. This concept becomes crucial in adulthood, and to teach the same, employing strategies that do not feel heavy and are fun yet logical for the individual is always a win-win! In this post, we talk about why budgeting is crucial and how inquisitive minds can learn this while indulging in some fun activities. If you can’t make that budget a reality, or if you’re struggling to get a handle on your finances, budgeting might not be enough for you.

t Grade Budgeting Lesson Plans

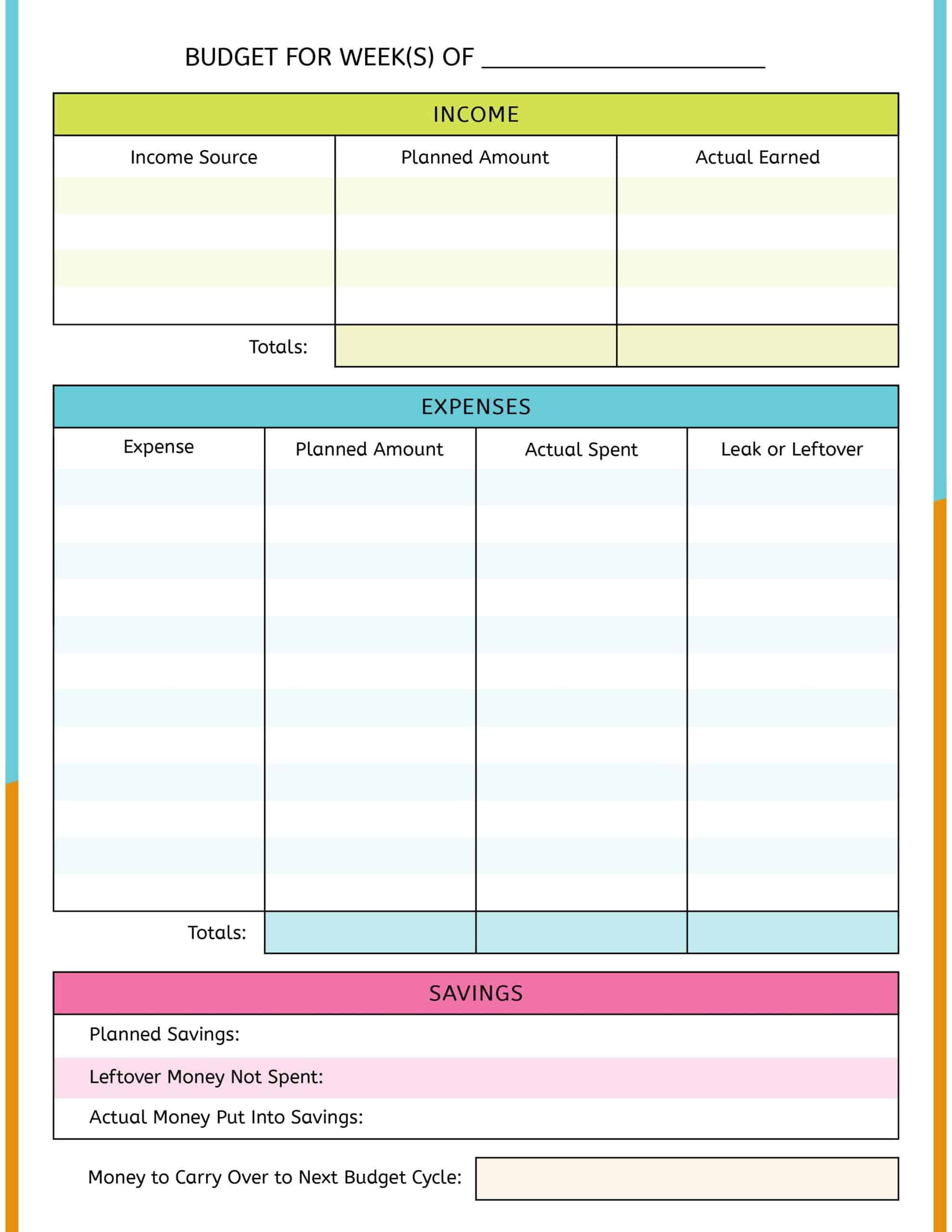

This type of top-down budget planning is useful for large companies, especially if they operate nationwide, because it simplifies complex budgets for low-level implementation. However, this budgeting is sometimes criticized for oversimplification or manipulation to create the appearance of success. They’ll need a bigger area for their budget reflection on this worksheet. In this section, they’ll look at totals for all of their spending, totals for all of their savings, money they have leftover for next budget cycle, and the percentages. Not only will they calculate their planned spending vs. actual spending, but they’ll also get practice calculating budgeting percentages to see how they’re lining up with their priorities. This is important, because in Level 3 (and adulthood) they’ll need to look at their budget in terms of categories, and be able to budget their money within a category instead of just by each specific item.

- A fun activity to kick off money lessons or a money unit would be to have your students go through this Reality Check calculator.

- For starters, they want to start looking beyond just this week or this two-week period that they’re budgeting for, and instead look at the entire month.

- Here’s a twist on the “traditional” budgeting games out there – in this one, kids will need to plan their budget before they actually get to Payday on the board.

- And you don’t even have to be a Mint user to have access to them.

- Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

And you don’t even have to be a Mint user to have access to them. Cents and Order Budget Binder Printables complete set of budgeting printables can help you manage your finances in several ways. You can create your budget, but you can also track which bills are due on what dates during the month.

Honestly, it seemed like a budget was nothing more than a parent telling me what I could and couldn’t do with my money. This blog has partnered with CardRatings for our coverage of credit card products. This site and CardRatings may receive a commission from card issuers.

To prepare this game, write potential purchases on index cards. Using one set of cards, divide the necessary objects from the unnecessary ones. Given the amount of monthly budget you have and your big expenses, it can be challenging to create an effective money management plan. However, financial skills are not simple to gain and apply to real life, especially for young adults. Financial literacy games are another great activity to guide high school students to self-discover vital money life skills. I’m including this financial literacy activity here because I think it’s pretty interesting.

If you achieve a long-term goal, it will be worth all your effort, time, and patience. In this case, your kid, tween, and teen get a $100,000,000 production budget to produce a five-star rated movie. They’re actually making a prediction about how much they’ll need to budget.